'India's insolvency and arbitration laws not a cure for all problems'

Though they are in sync with global practices, they have to undergo reform over time to keep pace with the needs of the economy, says Vivek Sood

image for illustrative purpose

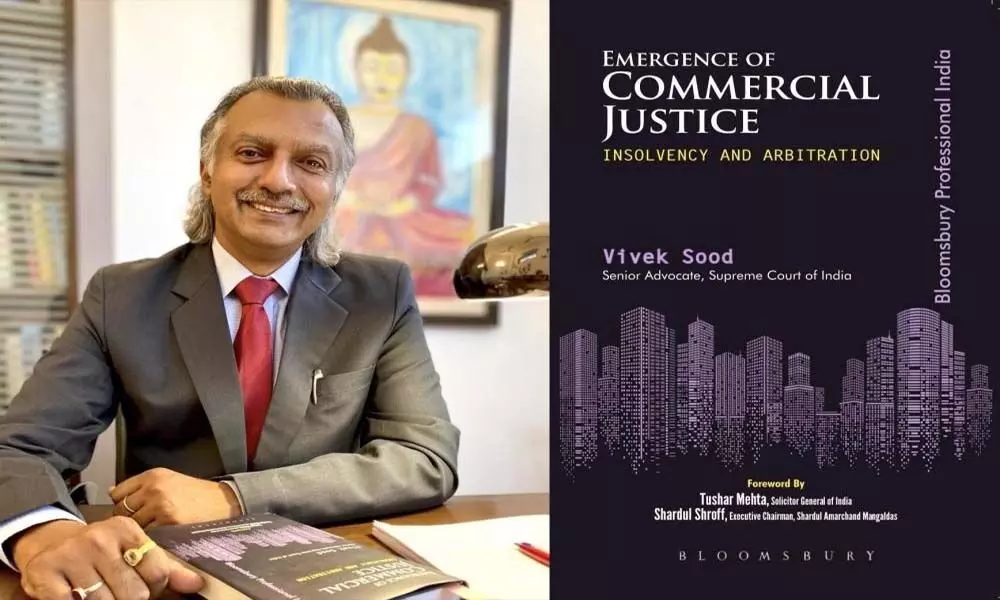

India's laws relating to insolvency and arbitration are in sync with global practices, but are not a 'cure for all problems' and would undergo reform over time to keep pace with the needs of the economy, says Vivek Sood, a Senior Advocate of the Supreme Court who has authored the first comprehensive book on the two statutes.

Indicative of the movement ahead are the recent amendments in the Insolvency and Bankruptcy Board of India Regulations which "are in the right direction as they strengthen the CIRP (Corporate Insolvency Resolution Process)," Sood, the author of "Emergence Of Commercial Justice - Insolvency And Arbitration" (Bloomsbury), told IANS in an interview

The amendments "should pave the way for corporate India into the future", Sood said, adding: "Of course, many other areas need reform too" and the Insolvency and Bankruptcy Code and the Arbitration and Conciliation Act "are not a cure for all problems".

"Free play in the joints ought to be given to the legislature and the executive while making economic laws and regulations. Economic regulations are an ever-evolving process that must keep pace with the needs of the economy," Sood noted. Elaborating on the benefits of the amendments, he said the duty imposed on the IP (Insolvency Professional) to find the changing names and registered offices of corporate debtors "is in public interest".

This is because stakeholders "may not be able to track the changing names and registered offices of corporate debtors and hence may not be able to participate in the CIRP. In order to plug this problem, the IP has been enjoined upon to track the changing names and registered offices of corporate debtors so that all stakeholders such as homebuyers and others can be parties to the CIRP".

Also, the amendments empower the IP to engage professionals for valuation of the assets, etc. of the corporate debtors. Valuation is a specialised field where professionals ought to be engaged and the IPs cannot be expected to delve into valuation exercises, Sood explained.

"This amendment would go a long way to professionalise the process of valuation of corporate debtors. Finding murky transactions of corporate debtors such as under invoicing, under valuation, and other fraudulent transactions will henceforth be the duty of the IP and place the same before the NCLT for appropriate reliefs.

"It's a significant step forward in public interest especially in the interests of creditors and resolution applicants who wish to stake their claims to take-over the corporate debtor," Sood added.

The book builds on the theme of Commercial Justice through the Insolvency and Bankruptcy Code of 2016 and the amendments in the same year in the Arbitration and Conciliation Act of 1996 "that brings the arbitration law in sync with the prevalent laws in advanced economies. The governments in the past also endeavored to bring in the concept of Commercial Justice through a gamut of laws but they failed on the ground," Sood said.

While Chapter 1 talks of earlier legislations and the change brought about by the IBC, Chapters 2 to 16 give instances of the effective application of the IBC and the Arbitration Act.

However, the cases of Vijay Mallya and Nirav Modi "are of different nature", though "dimensions" of Commercial Justice, and not the subject matter of the book as they are white collar crimes governed by other Indian laws. Sood explained. "Extradition issues are not part of this book. Those are also dimensions of Commercial Justice. Hope the laws would evolve so as to effectively bring these economic offenders before the justice system to face the trial," Sood added.

He also disagreed with a perception in some quarters that the two laws merely target the small fish while the larger fish get away. "There can't be parity in law with a wrong. Merely because the big fish are not netted and they get away, it doesn't make action against the small defaulters illegal. Each case has to be seen on its own merits. Also, the big fish are being caught these days. Hundreds of builders are languishing in jails across the country without bail. For e.g., PGF Directors have been in jail for over 5 years now. Similarly, Directors of Vigneshwara Developers too are in jail for over 4 years," Sood asserted.

Interestingly, the Parliamentary Standing Committee on Finance, chaired by BJP leader Jayant Sinha, in a report tabled in the Lok Sabha last week said that the IBC had deviated from its aim of offering a quick resolution to stressed companies and suggested a review due to this, as also low recovery rates and rising cases of liquidation.